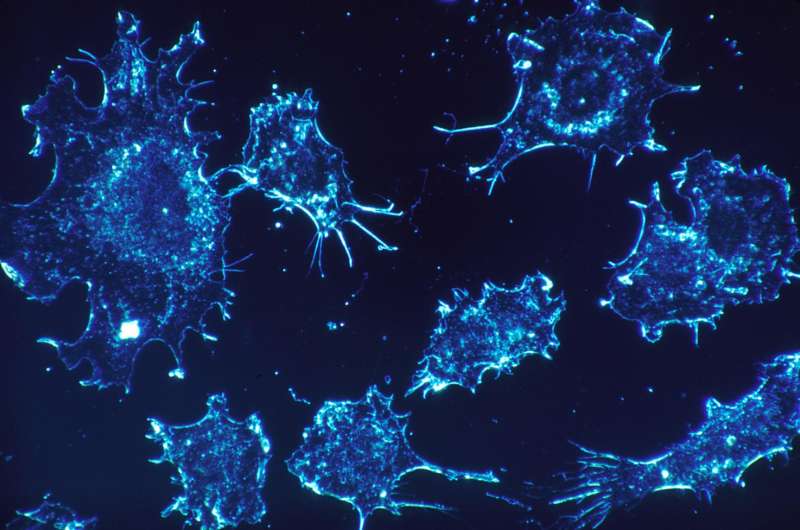

Credit: CC0 Public Domain

Adult survivors of childhood cancer face an increased likelihood of financial difficulties related to out-of-pocket costs for their health care, compared with adults not affected by childhood cancer. In their report published online in the Journal of Clinical Oncology, investigators from the Massachusetts General Hospital (MGH) Cancer Center also report that survivors of childhood cancer who pay higher out-of-pocket costs were more than eight times more likely to have trouble paying their medical bills than were either survivors not facing higher out-of-pocket costs or adults without a history of childhood cancer.

"Survivors who reported spending a higher percentage of their income on out-of-pocket medical costs were not only more likely to report financial burden, they also were at risk for undertaking behaviors potentially detrimental to their health in order to save money," says Ryan Nipp, MD, MGH Cancer Center, lead and corresponding author. "While studies have identified associations between financial burden and patients' treatment outcomes, quality of life and even survival among adults with cancer, as far as we know, this is the first to report these associations in survivors of childhood cancer."

Successful treatment of childhood cancers has led to an increase in the number of adult survivors, but studies also have reported that these individuals are at elevated risk for chronic health conditions, such as heart disease, kidney impairment, and secondary cancers. Many health care plans have increased the out-of-pocket costs for which patients are responsible through cost-sharing measures such as increased deductibles, copayments or coinsurance. The current study was designed to investigate the extent to which increased out-of-pocket health care costs pose a financial burden to survivors of childhood cancer and their potential consequences.

The research team surveyed participants in the Childhood Cancer Survivor Study (CCSS), which enrolled adults who had been treated for childhood cancers between 1970 and 1986 along with a control group of siblings not affected by cancer. In 2011 and 2012, a group of CCSS participants - both survivors and siblings—was surveyed regarding the type of health insurance they had; out-of-pocket health care costs paid during the previous year; income, employment and other sociodemographic information; as well as questions related to whether medical costs posed a financial burden and measures they had taken to deal with those financial pressures.

Complete responses—including information on income and out-of-pocket health care costs - were received from 580 childhood cancer survivors, who were an average of 30 years from their initial diagnosis, and 173 siblings. While 10 percent of survivors were determined to have a higher level of out-of-pocket health costs—defined as 10 percent or more of household income—less than 3 percent of siblings faced higher out-of-pocket costs.

Survivors reporting higher out-of-pocket health care costs were more likely to have lower incomes and to report being hospitalized in the past year. Measures they reported taking to offset these financial burdens included skipping treatments, tests or follow-up visits; postponing or delaying medical care, and taking smaller than prescribed doses of medication. Compared with both survivors paying lower costs and with siblings, survivors paying higher out-of-pocket costs were more likely to worry about their ability to access health care and to think about declaring bankruptcy.

Nipp says, "A more comprehensive understanding of the relationship between high out-of-pocket medical costs and the adverse effects of increased financial burden on cancer survivors could be instrumental in helping us identify those at risk for higher costs to help us address their financial challenges and improve health outcomes. It could also help inform policy changes to help meet the unique needs of cancer survivors and improve our understanding of how both higher costs and resulting financial burden influence patients' approach to their medical care and decision-making." He is an instructor in Medicine at Harvard Medical School.

The authors note that, since the study was conducted prior to the full implementation of the Affordable Care Act, there is no way of knowing how the ACA may have influenced the extent of high out-of-pocket costs and financial burden among survivors of childhood cancer, something that should be studied in future research. They also cite the need to study ways of incorporating financial discussions within survivorship clinics and developing programs including elements such as financial services, patient navigators and social workers to help patients plan for and deal with the economic challenges related to cancer and cancer care.

More information: Ryan D. Nipp et al, Financial Burden in Survivors of Childhood Cancer: A Report From the Childhood Cancer Survivor Study, Journal of Clinical Oncology (2017). DOI: 10.1200/JCO.2016.71.7066

Journal information: Journal of Clinical Oncology

Provided by Massachusetts General Hospital