Economist outlines reforms to improve access to affordable, high quality child care

For families in the U.S., the costs of high-quality child care are exorbitant, especially for those with children under age five. A new policy proposal, "Public Investments in Child Care," by Dartmouth Associate Professor of Economics Elizabeth Cascio, finds that current federal child care tax policies are not benefiting the families most burdened by child care costs. Therefore, Cascio outlines a new policy that could replace the current federal child care tax policies. The research examines child care for children ages 0-12 years, with a focus on 0-4 years.

The study was one of the papers published in The 51% Driving Growth through Women's Economic Participation, an e-book published by The Hamilton Project at Brookings in conjunction with the forum, "Policies to Promote Women's Economic Opportunity" on Oct. 19 at Stanford University, which was co-hosted by The Hamilton Project, LeanIn.org and Stanford Law School (#The51Percent). Cascio presented her policy recommendations at the forum's roundtable on "Expanding Access to Affordable, High-Quality Child Care."

To make high-quality child care more accessible, Cascio outlines three goals for her proposed reforms: 1) relieve the burden of child care costs for families, especially for the more, disadvantaged families; 2) encourage maternal employment, which is critical to building human capital in our society; and 3) recast how we think about child care, as it is a long term investment that supports child development.

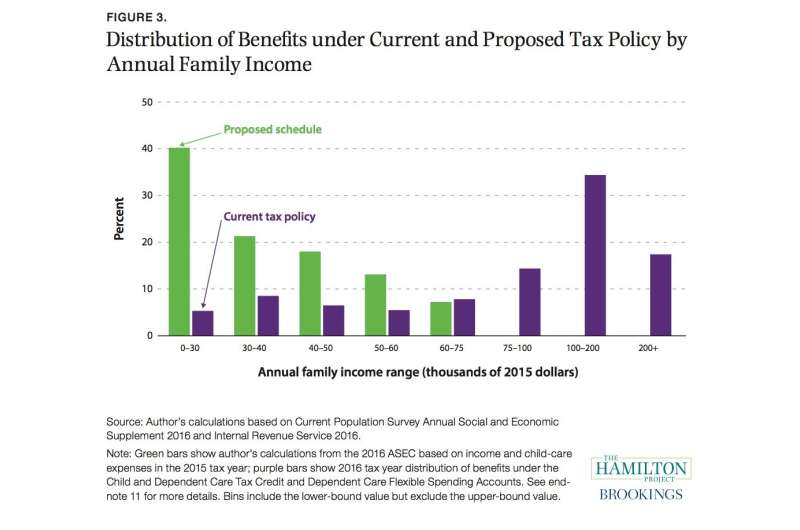

Using a multifaceted approach, Cascio proposes replacing current federal child care tax policies (i.e. Child and Dependent Care Tax Credit and Dependent Care Flexible Spending Accounts) with a new, refundable, new tax care credit that would benefit both lower-income families (earning less than $70K) and among these families, those with children under the age five. The new child care tax credit could be an advance credit that could be accessed throughout the year, enabling families to use the credit to pay child care bills, rather than receiving one lump-sum at the end of the year.

To address quality at child care centers, Cascio recommends continued investment in public preschool programs, particularly for 4-year-olds, and continued use of statewide rating systems known as Quality Rating and Improvement Systems, which serve as public report cards that can help hold child care centers accountable.

"Current federal childcare tax policy is inefficiently targeted, providing relatively small sums of money to the relatively well-off families that need it the least. Fortunately, there's a simple and sensible fix, one that would potentially generate a lot of benefits - for families, for kids, and for society at large," said Cascio.

More information: www.hamiltonproject.org/papers … onomic_participation