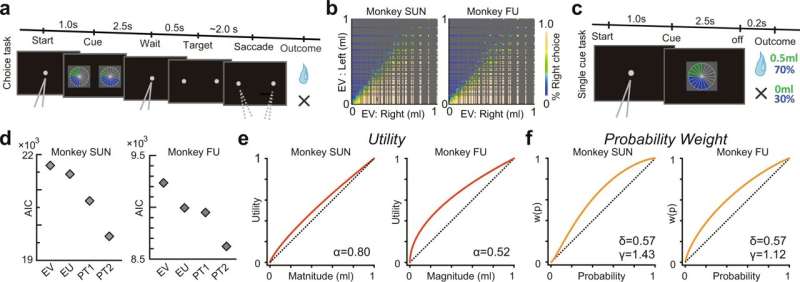

Cued lottery task and monkeys’ choice behavior. a A Sequence of events in the choice trials. Two pie charts representing available options were presented to the monkeys on the left and right sides of the screen. The monkeys chose either of the targets by fixating on the side where they appeared. b Frequency with which the target on the right side was selected for the expected values of the left and right target options. c Sequence of events in single-cue trials. d AIC values are estimated based on the four standard economic models to describe the monkey’s choice behavior: EV, EU, PT1, and PT2. See the Methods section for details. e Estimated utility functions in the best-fit model PT2. f Estimated probability-weighting functions in the best-fit model PT2. Images in panels a-c were created by the authors and previously published in Neural Population Dynamics Underlying Expected Value Computation. Hiroshi Yamada, et al. Credit: Nature Communications (2022). DOI: 10.1038/s41467-022-33579-0

The mechanisms underlying decision-making have been a long-standing focus of neuroscience research. But now, researchers from Japan have found new information about how the reward system in the brain processes risky decisions.

In a study recently published in Nature Communications, researchers from the University of Tsukuba have revealed that individual neurons in the neural circuit that processes reward information fire in accordance with a well-established theory used to describe the decision-making process.

First proposed in the 1970s, prospect theory is a highly influential concept used to describe how people and animals make choices. Although this theory has been supported by thousands of studies, limitations in the temporal and spatial resolution of human neuroimaging techniques have prevented researchers from determining whether the activity of individual neurons follows this pattern, something that the researchers at the University of Tsukuba aimed to address.

"Although the field of neuroeconomics has made great progress towards understanding how the brain makes economic decisions, we still don't know how the reward circuitry processes subjective value judgments in this context," say authors Professor Hiroshi Yamada and Professor in Economics Agnieszka Tymula. "This has important implications for understanding how subjective value judgments are related to perceptions regarding the probability of a given outcome."

To examine this, the researchers trained rhesus monkeys to perform two lottery tasks, one in which they chose between two options with different reward probabilities, and one in which they did not make a choice but received a reward at the end of the trial. Neural activity was recorded while the monkeys performed the tasks, and the correspondence between the behavioral task performance and the neural activity was evaluated.

"The results were surprising," explains author Professor Yasuhiro Tsubo. "We found that the single-neuron activity in four core areas of the reward circuit reflected the subjective value judgments made by the monkeys while they completed the economic decision-making task, indicating that the activity conformed to the prospect theory framework."

Furthermore, the neural activity patterns that corresponded to the prospect theory were distributed throughout many regions of the reward system.

"Our study is the first to show that prospect theory can be used to describe the activity of individual neurons in the reward system," says Professor Agnieszka Tymula.

That the activity of individual neurons in monkeys corresponds with their risk preferences and probability weighting behavior verifies the findings of neuroimaging studies in humans. Furthermore, this new evidence supports the idea of a neuronal prospect theory model in which computations are distributed across the neural structures that process reward. These results open up exciting new avenues for future work.

More information: Yuri Imaizumi et al, A neuronal prospect theory model in the brain reward circuitry, Nature Communications (2022). DOI: 10.1038/s41467-022-33579-0

Journal information: Nature Communications

Provided by University of Tsukuba