Allergan board turns down Valeant takeover offer (Update)

Botox maker Allergan formally rejected on Monday a takeover bid from Valeant Pharmaceuticals, saying that the unsolicited offer worth nearly $46 billion undervalues the company and poses a significant risk to its growth prospects.

Shortly after Canada's Valeant and activist investor Bill Ackman made their offer public last month, Allergan announced a so-called poison pill plan, a defensive tactic that makes a buyout prohibitively expensive. Allergan also told Valeant that it didn't want to discuss a tie-up, but said that it would evaluate the offer.

Valeant spokeswoman Laurie Little said Monday in an email that her company was disappointed that Allergan made its decision without "engaging in any substantive discussions" with Valeant or Allergan's largest stockholder, Ackman's Pershing Square Capital Management LP. She added that they remain committed to pursuing this deal.

Under the proposed deal, Valeant said that it would exchange each Allergan share for $48.30 in cash and a portion of shares of Valeant Pharmaceuticals International Inc.

Allergan stockholders would own 43 percent of the combined company under that proposal.

Pershing Square, which holds a 9.7 percent stake in Allergan, agreed to take only stock if the deal went through, and would remain as a long-term shareholder of the combined company.

Allergan Chairman and CEO David Pyott told analysts during a conference call Monday that he did speak with Ackman recently and listened carefully to the investor. But he added that Ackman was essentially a co-bidder with Valeant, and "his views and interests may not be completely the same as other stockholders."

A Pershing Square spokeswoman declined to comment on Allergan's rejection.

Allergan said Monday that Valeant's uncertain long-term growth prospects and business model create a risk for Allergan shareholders, especially given the stock component of the offer.

"In particular, we question how Valeant would achieve the level of cost cuts it is proposing without harming the long term viability and growth trajectory of our business," Pyott said in a letter to his counterpart at Valeant, Michael Pearson.

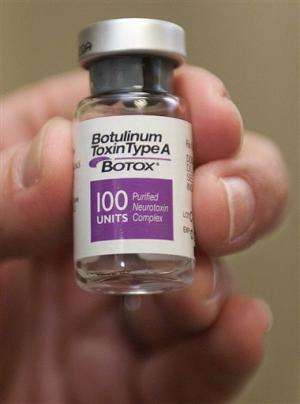

Allergan, based in Irvine, has long been considered one of the star performers in the specialty pharmaceutical sector. Revenue from its Botox treatment approached $2 billion last year.

The injectable drug is most famous for its ability to smooth wrinkle lines on aging foreheads. But over the years Allergan has racked up more than a half-dozen other approved uses for Botox, including treatment for neck spasms and migraine headaches.

Pyott detailed the growth of Botox and other drugs like the dry eye treatment Restasis in explaining Allergan's growth prospects as a stand-alone company. He said Allergan expects to increase adjusted earnings per share between 20 percent and 25 percent.

"We put our customers first, and we believe our ability to continuously gain market share is a direct result of our focus on our customers, physicians and their patients," he said.

Shares of Allergan Inc., which hit an all-time high this month, slipped $1.82 to $159.48 Monday morning while the Standard & Poor's 500 index rose slightly. U.S.-traded shares of Valeant, meanwhile, fell $1.61 to $129.56.

© 2014 The Associated Press. All rights reserved.