Valeant planning hostile bid for Allergan

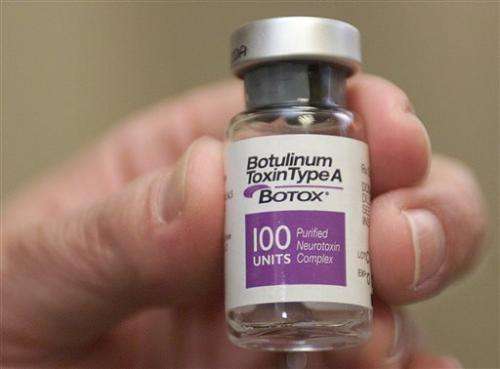

Valeant plans to take a buyout offer for Allergan directly to its shareholders this week, as the Botox maker continues to rebuff its proposals that have risen as high as $53 billion.

Valeant Pharmaceuticals International Inc. Chairman and CEO J. Michael Pearson said in a conference call Tuesday that proxies seeking support for its bid may be mailed in "the near-term."

"It is clear Allergan's management and their board will never sit down and act in the interest of their shareholders," he said.

Canadian-based Valeant has teamed with Bill Ackman's Pershing Square Capital Management to try to purchase Allergan. The two companies went public with their takeover attempt in April and have increased their offer several times.

Allergan Inc. has repeatedly rejected the offers as underpriced and risky. But Pearson said that Valeant believes an Allergan shareholder vote would "be overwhelmingly in support of the deal."

Valeant and Pershing—which has a 9.7 percent stake in Allergan—have continued to pursue Allergan despite the Irvine, California company's disinterest. The latest offer was worth about $53 billion. Allergan's market capitalization was about $48 billion in midday trading Tuesday.

Ackman previously said he would move to replace most of Allergan's board of directors as part of the battle for control of the company. Pearson said Tuesday that Pershing is looking to call a special shareholders meeting to remove six of Allergan's nine board members. Last week Pershing filed a lawsuit to confirm that its push for the special meeting won't trigger a defensive "poison pill" from Allergan.

Allergan adopted a one-year shareholder rights plan after Valeant and Pershing announced their bid in April. Under the plan, if any person or group acquires a 10 percent or greater stake in the company, other stock owners would be allowed to acquire additional shares at a discounted rate.

Pearson said that a special meeting of Allergan shareholders could be held in August, but should take place by year's end.

An email to Allergan for comment was not immediately returned.

Allergan's stock added $1.71, or 1.1 percent, to $161.07 in midday trading Tuesday, while shares of Valeant rose $1.95, or 1.7 percent, to $119.70.

© 2014 The Associated Press. All rights reserved.