Actavis to spend $66 billion on Allergan

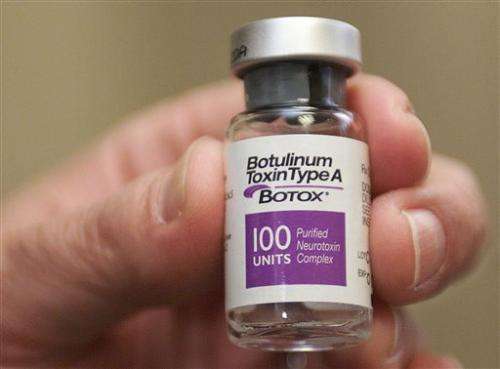

Actavis, which is buying Botox-maker Allergan for $66 billion in one of the biggest acquisitions announced so far this year, plans to stay committed to developing new products.

CEO Brent Saunders said Monday that the combined company will have more than two dozen products in late-stage clinical testing, which is usually the last and most expensive development phase, and it will work to support research.

"It is the lifeblood of our company," he told analysts.

Actavis and the company it outbid for Allergan, Valeant Pharmaceuticals, both have grown rapidly in recent years through multibillion dollar acquisitions of other drugmakers. But experts say developing new products internally is still the preferred method for revenue growth if—and this is a huge 'if'—enough of that research is successful.

"It's also really risky," said Erik Gordon, a professor at the University of Michigan's Ross School of Business who follows the pharmaceutical industry.

Allergan spent months fending off overtures from Valeant, in part because it thought the Canadian drugmaker would gut its research funding. The Irvine, California company also complained that Valeant's $53 billion bid was too low. Valeant Pharmaceuticals International Inc. partnered with the hedge fund and Allergan shareholder Pershing Square Capital Management on the bid.

On Monday, Actavis announced an offer of about $219 in cash and stock for each Allergan share that has the support of both companies involved.

"We are combining with a partner that is ideally suited to realize the full potential inherent in our franchise," Allergan Chairman and CEO David E.I. Pyott said in a statement from the drugmakers.

Valeant said separately that the Actavis bid was a price it "cannot justify to its own shareholders."

The deal announced on Monday comes months after Actavis polished off a $28 billion purchase of Forest Laboratories. Last year, it bought Ireland's Warner Chilcott for $8.5 billion and moved its headquarters to Dublin from Parsippany, New Jersey. That came a year it merged with generic drugmaker Watson Pharmaceuticals.

Actavis PLC also announced another deal update on Monday. It completed its offer to buy all outstanding shares of Durata Therapeutics Inc. in a deal worth about $675 million.

Other drugmakers like Merck & Co., and Novartis also have announced multibillion dollar transactions this year. Despite the flurry of deals, analysts say research and development of products remains the most efficient way for companies to grow revenue because they are not paying a premium for a company or drug that someone else has developed.

Mergers and acquisitions are more for filling gaps in a company's product portfolio or making up for a research failure, Gordon said.

Compared to mergers, research and development can be highly unpredictable and harder for the media to understand, said Steve Brozak, who follows the pharmaceutical industry for WBB Securities.

"Yet between the two, I'd always rather take R&D over (mergers), unless of course I'm a banker," he said. "You cannot come up with new drugs without research and development."

Shares of Allergan climbed about 4.7 percent, or $9.35, to $208 in Monday afternoon trading, while Actavis was up $2.28 to $246.05 and broader trading indexes were nearly flat.

© 2014 The Associated Press. All rights reserved.