Divorce costs thousands of women health insurance coverage

(Medical Xpress)—About 115,000 women lose their private health insurance every year in the wake of divorce, according to a University of Michigan study.

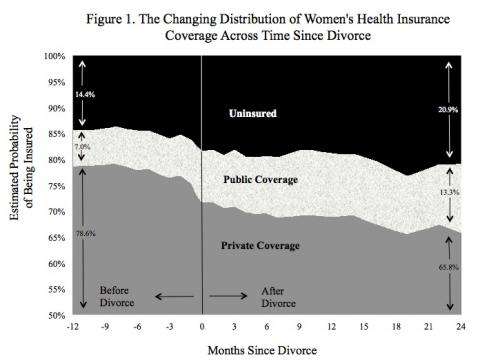

And this loss is not temporary: women's overall rates of health insurance coverage remain depressed for more than two years after divorce.

"Given that approximately one million divorces occur each year in the U.S., and that many women get health coverage through their husbands, the impact is quite substantial," says Bridget Lavelle, a U-M Ph.D. candidate in public policy and sociology, and lead author of the study, which appears in the December issue of the Journal of Health and Social Behavior.

Lavelle conducted the study, which analyzes nationally representative longitudinal data from 1996 through 2007 on women between the ages of 26 and 64, with U-M sociologist Pamela Smock. Their research was supported by the U-M National Poverty Center.

Among the other key findings of the study:

- Each year, roughly 65,000 divorced women lose all health insurance coverage in the months following divorce. Many women have trouble maintaining private insurance coverage because they no longer qualify as dependents under husbands' policies or have difficulty paying premiums for other sources of private insurance. And despite the financial hardship divorced women often experience, many do not qualify for Medicaid or other public insurance.

- Women insured as dependents on their husband's employer-based insurance policy are particularly vulnerable to loss of coverage after divorce. Nearly one-quarter of them are uninsured six months after divorce.

- Women who have their own employer-based coverage are less likely than other women to lose coverage (11 percent vs. 17 percent) but they are not completely immune from loss of coverage because financial losses related to the divorce may reduce their ability to meet ordinary expenses, including their share of employee-sponsored health insurance.

Lavelle and Smock also found that full-time work and education are important buffers protecting women from losing health insurance after divorce. But since many women work part-time, or in jobs that don't provide health insurance coverage, the protective effects of employment are not universal.

"The current health care and insurance system in the U.S. is inadequate for a population in which multiple marital and job changes over the life course are not uncommon," Lavelle and Smock conclude. "It remains to be seen how effective the Affordable Care Act will be in remedying the problem of insurance loss after divorce, but the law has provisions that may help substantially."

In the meantime, tens of thousands of women lose their private health insurance every year – in addition to all the other economic losses that accompany divorce.

More information: hsb.sagepub.com/content/early/ … 46512465758.abstract