What you pay for Medicare won't cover your costs

(AP) -- You paid your Medicare taxes all those years and think you deserve your money's worth: full benefits after you retire.

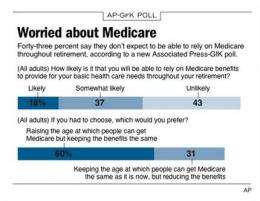

Nearly three out of five people say in a recent Associated Press-GfK poll that they paid into the system so their benefits shouldn't be cut.

But a newly updated financial analysis shows that what people paid into the system doesn't come close to covering the full value of the medical care they can expect to receive as retirees.

Consider an average-wage, two-earner couple together earning $89,000 a year. Upon retiring in 2011, they would have paid $114,000 in Medicare payroll taxes during their careers.

But they can expect to receive medical services - from prescriptions to hospital care - worth $355,000, or about three times what they put in.

The estimates by economists Eugene Steuerle and Stephanie Rennane of the Urban Institute think tank illustrate the huge disconnect between widely-held perceptions and the numbers behind Medicare's shaky financing. Although Americans are worried about Medicare's long-term solvency, few realize the size of the gap.

"The fact that you put money into the system doesn't mean it's there waiting for you to collect," said Steuerle.

By comparison, Social Security taxes and expected benefits come closer to balancing out.

The same hypothetical couple retiring in 2011 will have paid $614,000 in Social Security taxes, and can expect to collect $555,000 in benefits. They will have paid about 10 percent more into the system than they're likely to get back.

Many workers may believe their Medicare payroll taxes are going for their own insurance after they retiree, but the money is actually used to pay the bills of seniors currently on the program.

That mistaken impression complicates the job for policymakers trying to build political support in coming months for dealing with deficits that could drag the economy back down.

Health care costs are a major and unpredictable part of the government's budget problems, and Medicare is in the middle. Recent debt reduction proposals have called for big changes to Medicare, making the belt-tightening in President Barack Obama's health care law seem modest. Some plans call for phasing out the program, replacing it with a fixed payment to help future retirees buy a private plan of their choice.

Peel back the layers, and there are several reasons why Medicare benefits and taxes are so out of line. First, the rapid rise in health care costs.

A single woman who retired in 1980, after earning average wages throughout her career, could expect to receive medical care worth about $74,800 over the rest of her lifetime. A comparable woman retiring in 2010 can expect services worth $181,000. Those numbers are in 2010 dollars, adjusted for inflation so they can be compared directly.

Another reason is that payroll taxes cover most, but not all, of Medicare's costs. They are earmarked for the giant trust fund that pays for inpatient care.

Outpatient doctor visits and prescription drugs are paid for with a mix of premiums from collected from beneficiaries and money from the government's general fund. Seniors pay only one-fourth of the costs of those benefits through their premiums.

The system has worked for 45 years, with occasional fine tuning. But the retirement of the baby boomers, the first of whom become eligible for Medicare in 2011, threatens to push it over the edge.

Medicare covers 46 millions seniors and disabled people now. When the last of the boomers reaches age 65 in about 20 years, Medicare will be covering more than 80 million people. At the same time, the ratio of workers paying taxes to support the program will have plunged from 3.5 for each person receiving benefits currently, to 2.3.

"With Medicare, we are all still making out like bandits, shoving all those costs to future generations," said Steuerle. "At another level, we know that this system is totally unsustainable."

©2010 The Associated Press. All rights reserved. This material may not be published, broadcast, rewritten or redistributed.