This article has been reviewed according to Science X's editorial process and policies. Editors have highlighted the following attributes while ensuring the content's credibility:

fact-checked

peer-reviewed publication

proofread

Powerful financial giants could play vital role in preventing the next pandemic, say researchers

Many emerging and re-emerging infectious diseases, especially zoonotic diseases such as Ebola or new coronaviruses, emerge as the result of intensified human activities such as deforestation, expansion of agricultural land, and increased hunting and trading of wildlife.

In a new study, published in the journal Lancet Planetary Health, researchers identified public and private companies operating in economic sectors associated with increased risks of emerging and re-emerging infectious diseases.

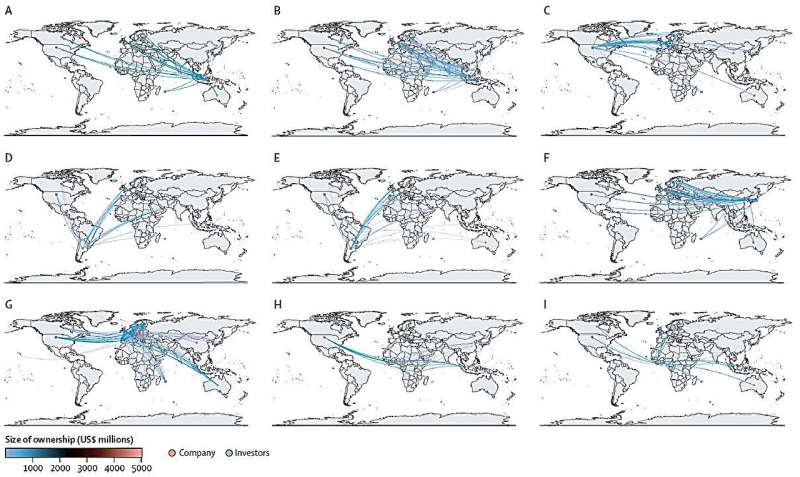

Where data was available, the researchers analyzed the financial entities with equity ownership in 99 identified public companies. They found that a handful of largely US-based financial entities, including Vanguard, State Street, BlackRock, and T Rowe Price, have substantial investments in these companies. But even public investors such as the state of California, Norway through its Sovereign Wealth Fund, and Sweden through its pension funds, hold shares in companies that operate in known regional hotspots for emerging infectious diseases.

"Financial actors have an important, but often ignored, role to help prevent the emergence of infectious diseases. Their investments enable economic activities in known zoonotic disease hotspots globally. Large investors hold potential influence over companies operating in these hotspots, and this influence could be leveraged to mitigate risks of new pandemics," says Victor Galaz, lead author of the study and senior researcher at the Stockholm Resilience Center at Stockholm University.

In the article, the researchers list a number of policies and practices that investors could push for, including ecological restoration measures, the creation of pathogen surveillance systems, and improvements in the health and economic security of communities living in geographical hotspots of emerging and re-emerging infectious diseases.

"Corporate policies that focus only on deforestation and land-use change are not enough to mitigate the risk of emerging and re-emerging infectious diseases. They fail to consider how agricultural expansion and deforestation increase the risk of pathogen spillover from reservoir to hosts. There is a need for policies to reduce the edge effect, create pathogen surveillance systems and improve the health care systems of communities living in areas that are emerging infectious hotspots," explains Paula A. Sánchez, researcher at the Stockholm Resilience Center and co-author of the study.

The study even identifies countries that either invest themselves or host headquarters of companies with investments in hotspots for emerging infectious diseases. These countries, including France, the U.S., Portugal, Norway, and Sweden, could work together to use financial influence to address the risks of outbreaks and pandemics, according to the study's authors.

"Among many other devastating effects of the COVID-19 pandemic, it has shown what enormous economic costs infectious diseases can have. Investing in sectors that could lead to new outbreaks therefore also carries significant financial risks that investors and governments need to proactively address," explains Victor Galaz.

He continues, "Such efforts have to go beyond current environmental, social, and governance metrics which have proven to be insufficient to show real-world ecological effects."

Data availability continues to be a limitation for the identification of potential alliances among investors and corporate actors.

"As emerging and re-emerging infectious diseases present a global risk to the economic and financial systems, there is a need to ensure standardized reporting of corporate and investment activities in infectious hotspots to reduce the risk of outbreaks at a global scale," says Paula A. Sánchez.

Peter Søgaard Jørgensen, another co-author associated with the Stockholm Resilience Center says, "Climate change will increase the risks of new zoonotic outbreaks. Financial actors should make sure that their investments help to mitigate and adapt to those risks."

More information: Financial influence on global risks of zoonotic emerging and re-emerging diseases: an integrative analysis, The Lancet Planetary Health (2023).