This article has been reviewed according to Science X's editorial process and policies. Editors have highlighted the following attributes while ensuring the content's credibility:

fact-checked

peer-reviewed publication

trusted source

proofread

Revealing the landscape of software as a medical device industry

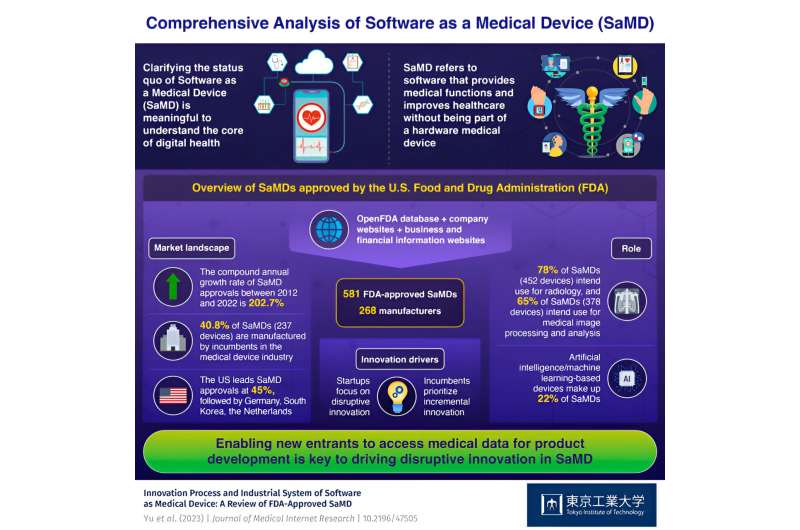

There has been a surge in academic and business interest in software as a medical device (SaMD). It enables medical professionals to streamline existing medical practices and make innovative medical processes such as digital therapeutics a reality. Furthermore, SaMD is a billion-dollar market. However, it is not clearly understood as a technological change and emerging industry.

This prompted researchers from Tokyo Institute of Technology to launch a new study. They reviewed FDA-approved SaMDs to shed light on the market landscape, the role of SaMDs, and the innovation within the industry. Their findings highlight the industry's diversity and potential for growth and advocate improving health care–related data access.

SaMD is an emerging field aimed at assisting medical professionals in diagnosing, monitoring, treating, or preventing diseases. The International Medical Device Regulators Forum defines SaMD as software intended for medical purposes, but not part of a hardware medical device.

This refers to a wide range of software such as health apps on smartphones or wearable devices that monitor and track health, as well as complex medical imaging software for X-rays, MRIs, and CT scans. However, the SaMD industry is still in its nascent stages of development and requires clarity on innovation, the market landscape, and the regulatory environment.

To address the limitations associated with current SaMD research, researchers from Tokyo Institute of Technology (Tokyo Tech) and the University of Tokyo recently conducted a comprehensive review of various aspects of SaMDs over the past decade, utilizing data from the U.S. Food and Drug Administration (FDA), the authoritative body for approving commercially marketed medical devices in the United States.

Professor Shintaro Sengoku, Jiajie Zhang, and Jiakan Yu, the authors of the study published in the Journal of Medical Internet Research, state, "The objectives of our work are to clarify the innovation process of SaMD, identify the prevailing typology of such innovation, and elucidate the underlying mechanisms driving the SaMD innovation process."

The researchers collected information on FDA-approved SaMDs from the OpenFDA website. They also gathered profiles of 268 companies associated with these devices from various sources, including Crunchbase, Bloomberg, PichBook.com, and SaMD company websites. To be considered a SaMD, a device had to function as standalone software fulfilling medical functions. Devices operating solely as part of hardware or requiring additional hardware were excluded from the review.

The findings reveal significant growth in the SaMD industry. Between 2012 and 2021, the number of FDA-approved SaMDs increased from one to 581. Most SaMDs were developed for medical image processing and radiological analysis (78%), followed by cardiology, neurology, ophthalmology, and dentistry. The researchers also identified notable progress in artificial intelligence/machine learning-based SaMDs, accounting for 22% of all FDA-approved SaMDs, marking what researchers are calling the "third AI boom" in health care.

The United States leads in SaMD approvals (262 devices, 45%), followed by Germany, South Korea, and the Netherlands. Established companies in the medical device industry such as Siemens, General Electric, and Philips launched the most SaMDs (237 devices, 40.8%). These companies focus on incremental innovations to improve existing medical processes, such as image resolution or reducing manpower requirements for medical image processing.

New entrants or start-ups that were formed after 2012 accounted for about 37% (215 devices) of the launches. These small and micro companies focus on disruptive innovation which enables new medical practices, such as digital therapeutics and remote monitoring. Another notable player is the pharmaceutical industry, which is actively engaged in the digitalization process of health care, with significant investments in SaMD initiatives.

The study highlights the diversity and emerging nature of SaMD, its potential for growth, and its transformative impact on health care services. The findings emphasize that accelerated growth in this sector is closely linked to data accessibility in driving disruptive innovation within the industry. New entrants focusing on disruptive innovations will need to build their datasets or access existing data within the health care system.

"Governments and academic institutions should facilitate data accessibility as a public good to accelerate innovation in SaMD," conclude the three authors, outlining recommendations for future developments in the industry.

More information: Jiakan Yu et al, Innovation Process and Industrial System of US Food and Drug Administration–Approved Software as a Medical Device: Review and Content Analysis, Journal of Medical Internet Research (2023). DOI: 10.2196/47505