July 5, 2024 feature

This article has been reviewed according to Science X's editorial process and policies. Editors have highlighted the following attributes while ensuring the content's credibility:

fact-checked

peer-reviewed publication

trusted source

proofread

Study explores the link between stock market fluctuations and emergency room visits in China

The advent of computerized trading and fintech platforms has made investing in stocks easier and more accessible to individuals worldwide. This has led to an increase in stock market participation in many countries, including China.

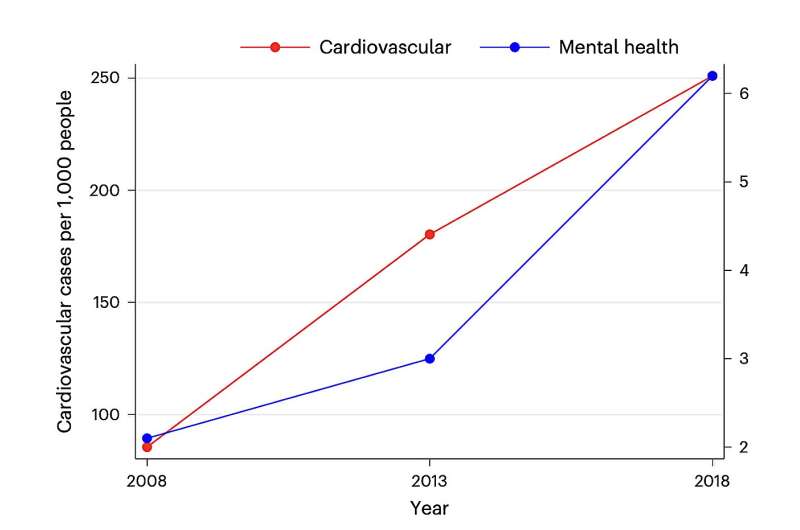

From 2000 to 2022, the number of people investing in stocks in China rose from 29.3 million to a staggering 322.6 million. As a result of this spike in investments, fluctuations in the stock market can have a significant effect on the finances of numerous individuals and their families.

Drastic changes in wealth or financial difficulties resulting from these stock market fluctuations could potentially also affect the mental and physical health of investors. In fact, some recent reports have found a correlation between stock market fluctuations and specific physical and psychological issues.

Researchers at the National University of Singapore, Jinan University, Peking University and Sun Yat-sen University recently explored this potential link further, focusing on the relationship between stock market fluctuations and stress-related emergency room visits in China. Their findings, published in Nature Mental Health, unveiled a trend marked by greater visits to emergency rooms by individuals experiencing stress-related mental health issues during periods of stock market volatility.

To study the relationship between stock market fluctuations and emergency room visits in China, this team of researchers statistically analyzed data collected at the largest hospitals in Beijing over the course of three years, spanning from 2009 to 2012. This data, which was specific to emergency room visits for reasons potentially related to stress, was analyzed in conjunction with stock market trends in China during the same period.

"Using daily emergency room visit records from the three largest hospitals in Beijing from 1 January 2009 to 31 December 2012, we find that a one percentage point decrease in daily market returns (Growth Enterprises Index) is associated with 0.185 (P = 0.040, confidence interval (CI) = 0.009 to 0.361, or 0.7%) increased cases of cardiovascular diseases and 0.020 (P = 0.060, CI = 0 to −0.041, or 2.5%) increased cases of mental disorders on that day," Sumit Agarwal, Siyu Chen and their colleagues wrote in their paper.

"Moreover, a one percentage point increase in daily market returns (Growth Enterprises Index) is associated with 0.035 (P = 0.007, CI = 0.010 to 0.059, or 3.3%) increase in cases of alcohol abuse on that day."

Overall, the results of the analyses run by Agarwal, Chen and their colleagues suggest that stock market shocks had immediate effects on cardiovascular diseases and mental health disorders in the period ranging between 2009 and 2012, as volatility in stock markets was linked to more visits to the emergency room for these stress-related physical and mental issues. As the data used by the researchers was over a decade old, they highlighted the need for additional studies using newer medical and financial data.

"The health effects are highly nonlinear, instantaneous and more salient for older people and males," Agarwal, Chen and their colleagues wrote.

"By contrast, diseases that are less related to psychological stress (for example, infections and parasitic diseases) are not significantly affected by market fluctuations. A back-of-the-envelope calculation suggests that a ten percentage point decrease in daily market returns is associated with an approximately RMB 35 million increase in national medical expenses related to emergency room services."

This recent study could soon inspire further research examining the health-related costs of stock market fluctuations. In their paper, the researchers also hint at the possibility of conducting additional studies on this topic using the digital medical data collected during the COVID-19 pandemic, when more individuals accessed online medical services instead of visiting health care facilities.

More information: Sumit Agarwal et al, Associations between stock market fluctuations and stress-related emergency room visits in China, Nature Mental Health (2024). DOI: 10.1038/s44220-024-00267-5

© 2024 Science X Network