Nutrient-based tax could cut nation's medical bills

(Medical Xpress)—To reduce obesity-related disease in America, many policymakers and public health officials have proposed either taxing products that make us fat or taxing individual nutrients in fattening foods, like sugar and fat itself.

Researchers at Cornell and Stanford universities modeled both approaches, using data from more than 123 million purchasing decisions by food and beverage shoppers. (Their economic model included a range of nutrients, including a third commodity – salt – because of its role in heart disease.) Their results are reported in a January 2014 working paper published by the National Bureau of Economic Research.

"Nutrient-specific taxes could have an important effect in inducing healthier purchasing behavior among consumers," Cornell's Michael Lovenheim and Stanford's Matthew Harding concluded.

Specifically, a nationwide tax on sugar would have the broadest positive effect, they conclude, because so many processed foods have lots of sugar – and consumption of fat and salt in those sugary products would be collaterally reduced when consumers are faced with a sugar tax. A tax on fat would be almost as effective, researchers said, but might make consumers switch from dairy-based drinks to soda pop. Taxing salt, directly, they said, would have fewer positive effects.

Either of two kinds of excise taxes might discourage unhealthy eating behavior, they proposed. A 20 percent tax on a product category, such as candy, would raise the price of a $2 candy bar to $2.40 (plus sales tax, where applicable).

But tax-adverse consumers, desperate for their salt/sugar/fat fix, could easily switch from candy to another snack category not already taxed – or even invented, yet, by the processed food industry – like the hypothetical "SeaSaltCaramelDeep-friedPorkRinds."

Unless, that is, the individual, unhealthy commodities are taxed at the supply side – before they get to the candy factory of the Heart-Stopping Snack Co. That way, researchers said, the price premium on unhealthy products would be unavoidable. They estimated that a 20 percent tax on sugar, for example, would reduce consumption – and calories – by about 18 percent.

"Taxes on nutrients would do much more to support healthier nutritional choices than would taxes on products," said Lovenheim, associate professor of policy analysis and management in Cornell's College of Human Ecology.

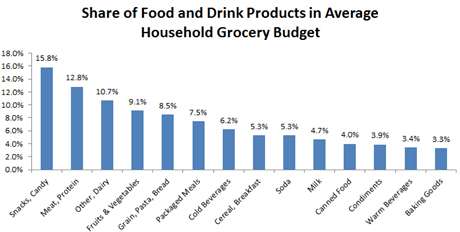

"Our model predicts that people would reduce purchases – and calories, too – with a tax on unhealthy nutrients," Lovenheim added, displaying a revealing graph.

That graph, titled "Share of Food and Drink Products in the Average Household Grocery Budget," leads with "snacks and candy," at 15.8 percent of the grocery bill – compared with 10.7 percent for "fruits and vegetables" and 5.3 percent for "cereal and breakfast."

Unhealthy-nutrient taxes would be even more effective if they were applied on a nationwide basis, Lovenheim thinks, to keep people from crossing state lines (or going online) to get tax-free unhealthy goods.

"In a way, we're already paying a 'fat tax' for eating unhealthy food and failing to exercise," the Cornell economist observed. "Obesity-related disease costs American taxpayers and health care consumers more than $147 billion a year."

More information: "The Effect of Prices on Nutrition: Comparing the Impact of Product- and Nutrient-Specific Taxes." Matthew Harding, Michael Lovenheim. NBER Working Paper No. 19781, Issued in January 2014. www.nber.org/papers/w19781