This article has been reviewed according to Science X's editorial process and policies. Editors have highlighted the following attributes while ensuring the content's credibility:

fact-checked

trusted source

proofread

Hospital prices, not insurance rates, may be cause of increased cost strain on consumers

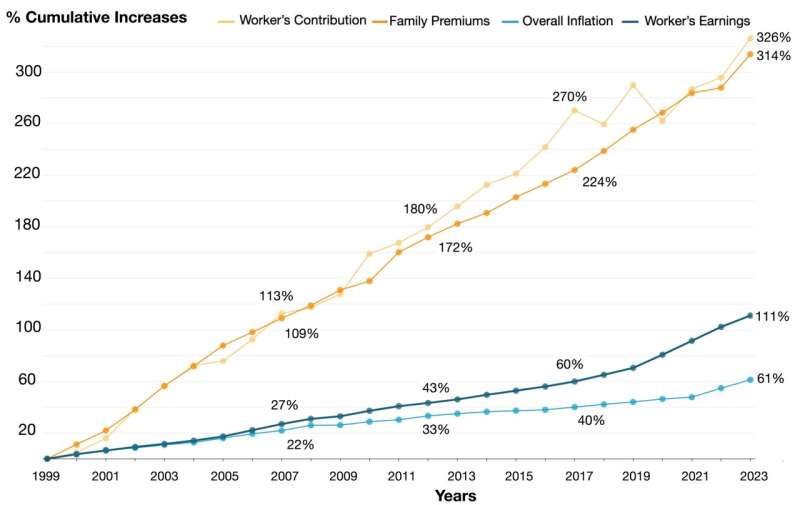

The gap between health insurance costs and workers' wages has significantly expanded, and this trend has not only led to significant concerns about health care affordability but raised questions regarding whether hospitals or health insurance companies bear the blame for escalating costs, according to new research from Rice University's Baker Institute for Public Policy.

In the Health Affairs Scholar report "Why Does the Cost of Employer Sponsored Coverage Keep Rising?," authors Vivian Ho and Salpy Kanimian examined consumer price indices for health insurance, hospital services and professional services from 2006 to 2023 using Bureau of Labor Statistics data. The analysis shows that the hospital price index rose steadily between these years—faster than insurance premiums or professional services.

"The public is quick to blame insurance companies for the rising cost of insurance, but with all of the recent news about rising hospital prices, we were curious to see whether the underlying price of health care is the driver of expensive premiums," Kanimian said.

According to the Texas Medical Center's Consumer and Physician Surveys, 28% of consumers and 47% of physicians blamed rising health care costs on insurers, while only 10% of consumers and 9% of physicians blamed hospitals.

The authors evaluated the profit margins of hospitals and health insurance companies and found that hospitals (both for-profit and nonprofit) have consistently maintained higher profit margins than insurance companies. Price increases for hospital care have risen faster than the physician price index or insurance premiums net of medical service costs, the report says. Profits for hospitals have also been higher than those for insurers.

Hospitals that enjoy monopoly power as the sole provider in their local market have prices 12.5% higher than markets with four or more hospitals, according to the report. After hospital mergers occur, prices rise by 6% if the merging hospitals were close neighbors.

"Hospital systems have tried to justify their high prices by arguing that inflation post-COVID has raised their cost of labor and supplies," Ho said. "Health care workers performed heroically during the pandemic, yet their managers are charging prices well above their costs, which is placing an extraordinary burden on American workers."

More information: Salpy Kanimian et al, Why does the cost of employer-sponsored coverage keep rising?, Health Affairs Scholar (2024). DOI: 10.1093/haschl/qxae078